The Current Canadian Housing and Debt Market

The Current Canadian Housing and Debt Market

It’s no secret that Canadian household debt levels are staggeringly high. For every dollar of disposable income there is a corresponding $1.72 worth of debt. This ratio of household debt to disposable income gets even worse when analyzing lower income earners as they are shouldering the heaviest burden. Canada’s lowest-income households owe a staggering $3.33 for every dollar they bring home. Canada’s low interest rate environment has certainly been a breeding ground for debt loads spiraling out of control. Many individuals continue to stretch themselves thin and barely live within their means. One report came out last year suggesting that more than half of Canadians are living within $200/month of not being able to pay their bills or meet their debt obligations. It’s no wonder many Canadians find themselves in the position they’re in today. Even with mortgages making up a considerable portion of the debt load, there is another instrument that has become quite popular.

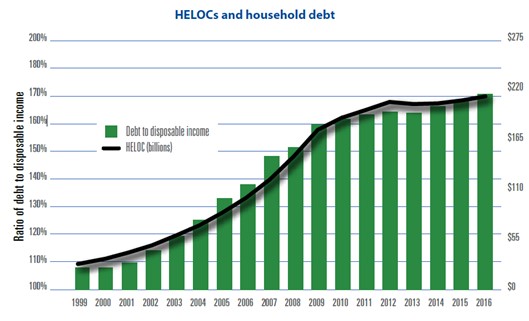

As home prices rose tremendously in the last 20 years, many Canadians were eager to take advantage. Enter the Home Equity Line Of Credit, or HELOC, an instrument where a lender allows a borrower to withdraw a portion of cash against the equity in their home. The market for HELOC’s expanded rapidly during the 2000s. Balances grew from $35B in 2000 to approximately $186B in 2010, an average annual growth rate of 20%. During this period, HELOC’s emerged as the largest form of non-mortgage consumer debt, accounting for nearly 40%. With only moderate growth over the last several years, outstanding HELOC balances reached $211B in 2016, good for an annual growth of roughly 2.5% in that time span.

While growth has been moderate over the last several years, it’s still substantial when looking at the bigger, cumulative picture. The recent introduction of new regulations and guidelines put in place to cool the overall housing market is probably the main culprit for the slow down.

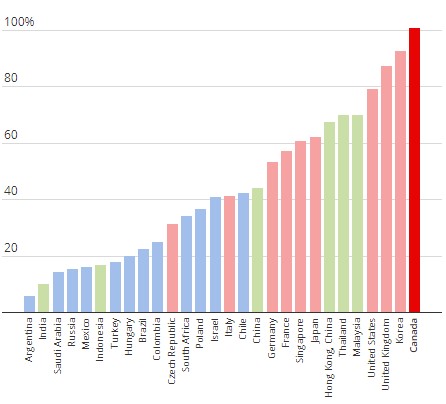

To further illustrate the problem, the OECD calculated household debt levels in 28 OECD nations and compared those figures to the size of the overall economy.

With interest rates having creeped up, (the BoC recently raised the benchmark rate to 1.25% after being stuck at 0.5% for nearly two years) it’s obvious where the glaring issue lies. Early last year, Economists at the Bank of Montreal took a deeper dive into mortgage payments as a percentage of income. At the time, they found that figure to be around 60% and on a steady rise with estimates of it reaching around 80% by the end of 2018. The last time this ratio was so high was back in 1989, the same year the Toronto Real Estate market crashed. Stephen Poloz, obviously aware of the current situation, was actually taking a more cautious approach in recent months stating that rate decisions would be driven by economic data, rather than prescribed. In a press release from December 14th, 2017, he and the BoC stated that they continue to be preoccupied by high home prices and elevated household debt, among other things. Fast forward to January 17th this year and all of a sudden that sentiment changed with the decision to raise the benchmark rate by 25 bps. This may not look very pretty on the surface, but the impending doom many are awaiting doesn’t seem so imminent, yet.

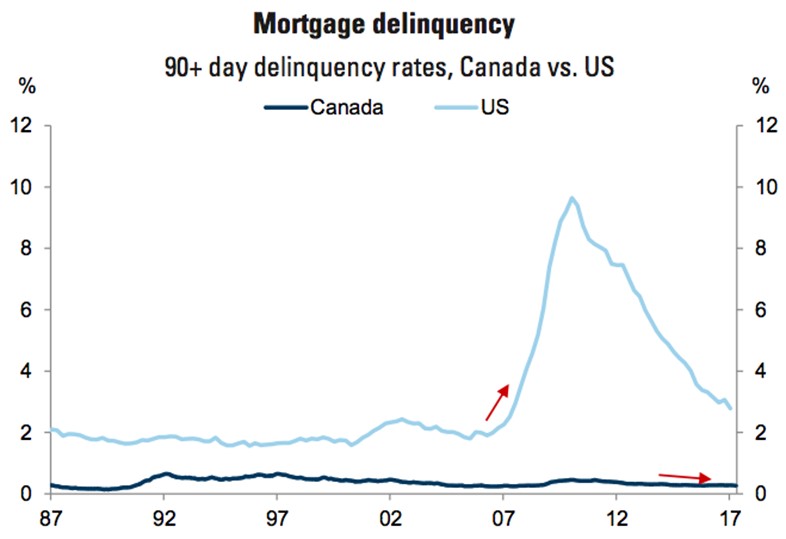

If you recall Jared Vennett’s rather animated pitch using Jenga blocks to get his point across (For the big short fans https://www.youtube.com/watch?v=xbiDrzTd8fE) to Mark Baum and the Front Point Partners team about why they should short housing bonds, you would remember him saying default rates were already up from 1% to 4% and if they hit 8% the bonds fail. For those who remember, this is exactly what happened. However, from the chart above, it’s quite clear we’re nowhere near those levels yet. In fact, the delinquency rates in the hottest housing markets (Toronto and Vancouver) are just 0.12% and 0.15%, respectively, compared to a national average of 0.34%.

While the majority of the points stated above would lead many to believe we’re on the brink of “housing Armageddon”, the corresponding delinquency rates just aren’t there. This isn’t to say that everything is okay, though, because, when it comes to debt obligations, mortgages are usually the last block to fall as home owners prioritize this payment over everything else. With that said, trying to postulate the effect current debt loads will have on the economy would be asinine. The same American economy that went belly-up in 08 was referred to as “hunky-dory” by then former chairman of the Fed, Alan Greenspan. One thing for sure is that pundits will continue to speculate on how this will play out, but only time will really tell.

Sources:

Financial Post

Globe and Mail

Canadian Business

Financial Consumer Agency of Canada

CBC

The Big Short